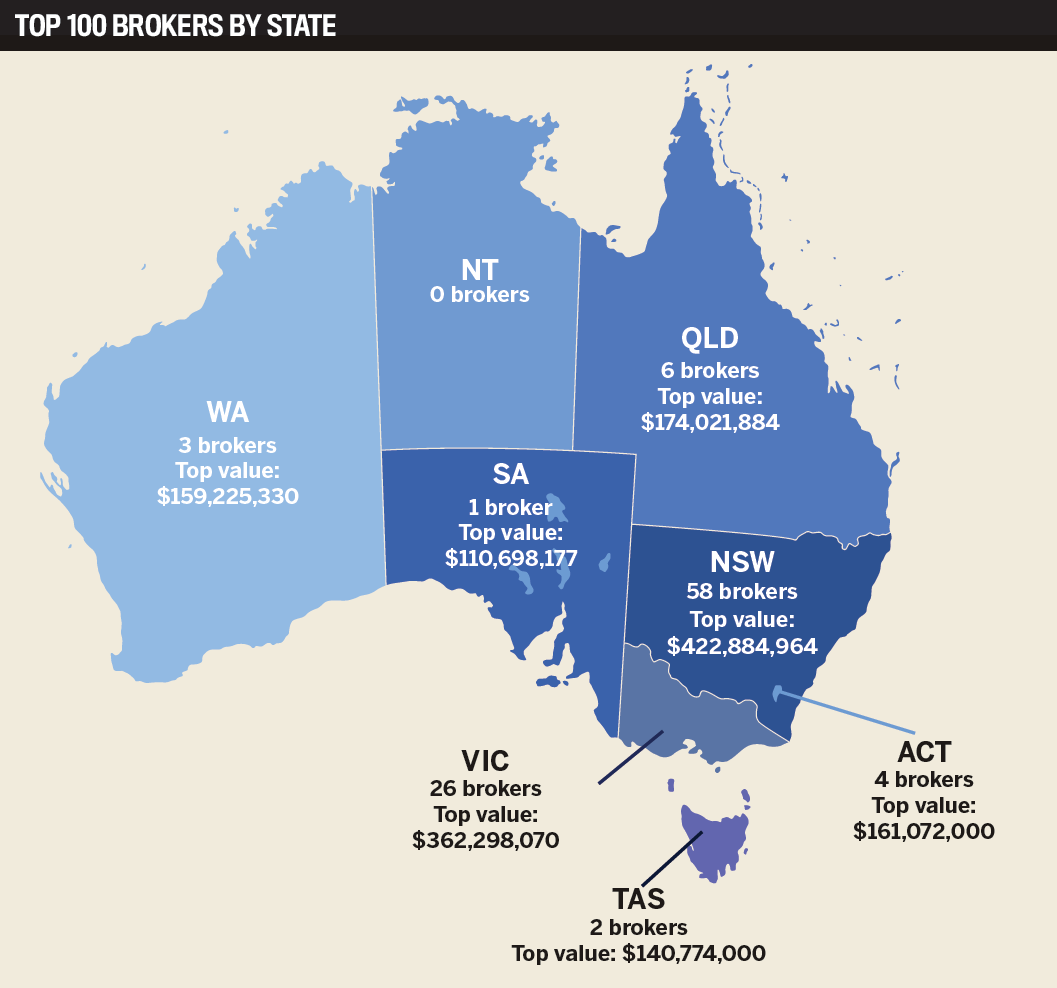

In FY21, top broker Justin Doobov wrote almost $423m – the highest figure MPA has seen on this list. Previously, the highest value written was $360m in 2017, also achieved by Doobov. The value reported by the number two broker this year – Mark Davis – also broke the original record, but at $362m was not quite enough to take the top spot.

Incredibly, the total value of home loans written across the entire Top 100 in 2021 was about $4bn higher than ever before. This is not surprising given the incredibly high numbers across the entire list.

To break into the Top 100 this year, a broker needed to write at least $98,204,047; last year, the barrier was much lower, with the lowest value of loans written in FY20 at $74,601,243.

It’s not just a matter of loan sizes being higher this year; the average number of home loans written by the top brokers was 270, up from 210 last year.

The top brokers’ 2021 figures are impressive enough, but even more so when compared to previous years’ results.

In 2019, the value of home loans written by the top broker dropped below $200m. The combined value of settlements across all brokers showed decreasing numbers for the fourth consecutive year, reflecting the environment during and post the banking royal commission.

It’s encouraging to see that the numbers in 2021 have not only bounced back but risen higher than ever before, which is especially notable after the confusion and complexity of the market during the pandemic.

Record-breaking lending values

It would have been difficult to foresee such high numbers at the onset of COVID-19 in 2020, when there were fears that the uncertainty would dampen borrower sentiment. But in fact the Australian market quickly saw a huge rise in borrower activity.

In the earlier months of the pandemic there was a particular surge in refinancing, which is where most brokers saw their activity come from. Refinancing was already looking high in the first couple of months of 2020, but in May of that year, refinance figures for both investors and owner-occupiers surpassed $14bn – $4bn more than in January.

In the months that followed, refinancing figures bounced around, but in the final two months of FY21 they surged again and ended the financial year above $16bn.

Borrowers still wanted to purchase homes, though. The total value of home loans reached a record $23bn in November 2020 and continued to grow each month until it peaked in May 2021 at an incredible $32.56bn.

The latest lockdowns may have contributed to a slight drop in figures, but they remained above $30bn even in August.

First home buyers were a particular driver of the heightened demand last year, as they took advantage of low interest rates and government incentives like the First Home Loan Deposit Scheme. The scheme meant that eligible first home buyers could purchase a home with as little as a 5% deposit.

In numbers not seen since 2009, loan commitments by first home buyers reached above 10,000 in July 2020. The numbers climbed higher each month, peaking at 16,257 in January 2021. Although they have since dipped, first home buyer loans have remained above 12,000.

At peak numbers, first home buyers made up about 42% of all loan commitments for dwellings.

The increase in total home loan values written by brokers in 2021 can be put down to more than one factor. Beyond simple demand, rising house prices have played a big role in driving the record values. By the end of October 2021, average house prices across all capital cities in Australia had risen by just over 20% year-on-year.

According to last year’s Top 100 Brokers report, Sydney’s median dwelling value was then $859,943. This year, CoreLogic’s October 2021 figures showed the city’s median dwelling value to be $1,071,709.

Every capital city has recorded monumental increases in dwelling prices, but the biggest change was in Hobart, which has seen a 28% year-on-year hike.

With low interest rates and high house prices, regulators have become concerned at the high debt-to-income ratio borrowers have been taking on. As a result, APRA announced in October that it would be increasing the minimum interest rate buffer that banks are expected to use when assessing the serviceability of a home loan.

By increasing the rate from 2.5% to 3%, APRA expects the maximum borrowing capacity for the typical borrower to reduce by around 5%.

Challenges faced by brokers

The pandemic period has meant brokers have needed to drastically adapt their business models, not just to handle the increase in business but also to ensure they could operate their businesses in a virtual environment. Brokers had to switch to working from home very quickly, which meant they had to not only move their teams to remote systems but also change the way they communicated with their clients.

Jabsons Finance founder Parth Shah says the biggest challenge for him was moving to remote working. As a broker who loves being face-to-face with his clients, he had to learn how to use new technology and then implement it within his business.

“I’m very old-school, so I prefer to see people face-to-face and generate business that way, and we were a very small team based in the office, so it was very challenging for me,” he says.

“We tried a few different things and luckily that worked, and we were able to continue servicing our clients.”

Shah also points out that in the five years since he became a broker, the broking industry has had to overcome constant challenges, such as changes coming from APRA and the royal commission.

Top broker Justin Doobov is also concerned about the level of regulation introduced in the industry. Reflecting on his last 20 years as a broker, he says he used to spend 20% of his time working on loan applications and the rest on value-add services. But now, 90% of his time is spent getting the loans approved.

“The regulation was all about putting the customer first so the customer wasn’t going to get ripped off, but it’s removed the service element of all broker business because brokers used to have a lot more time to service the customer, where now you spend most of the time collecting documents and filling in paperwork,” he said.

Brokers’ figures this year have shown just how well the industry has done despite the extra regulation, lengthy turnaround times, and the challenges of moving to remote working.

Read more about the experiences of some of MPA’s Top 100 Brokers over the following pages. Congratulations to everyone featured in this year’s list.